Chatting with a first generation Chiwi

Enna is a first generation ‘Chiwi’, a New Zealander born Chinese. She grew up having a ‘Kiwi life’ and a ‘home life’ and the only way she could mix the two worlds was through food.

Like many Chinese families that moved here in the early 2000’s, Enna’s parents too owned a takeaway. While other Kiwi kids spent their evenings in after school sport, Enna has memories of wrapping spring rolls, folding wontons, flipping burgers and eating yummy takeaway food.

Enna’s love for food has seen her take part in the NZ edition of My Kitchen Rules with her cousin May. They vowed to showcase as many Asian delights as they could while they were on the show and Enna has continued that journey of documenting what she eats and cooks through Instagram and her blog. In addition to this, she also works as a Marketing Manager at Ceres Organics and runs her own matcha business.

“Growing up, there was a time when I didn’t really care about my culture.” Like many immigrant kids, Enna struggled between wanting to fit in and pleasing parents who didn’t want their kids to forget about their heritage.

It’s taken growing up to understand the importance of heritage and why we all need to celebrate our individual cuisines.

On our episode we talk about:

- Growing up in an Asian immigrant family, what it was like

- Indian Chinese and how its so different to regular Chinese food

- The landscape of Chinese food in New Zealand and how it has changed

- The reality of being on a reality tv show

- Importance of documenting not just recipes but also food memories.

Listen to the Podcast Here:

Follow Enna on Instagram @cookwithenna or read her blog www.mayandenna.com

Quotes from the episode:

“Now if you go down Dominion Road you will see Chinese food that’s outside of the usual stuff we used to get. Gone are the fried noodles and now we have rice noodles, beef noodles, hand pulled noodles and all sorts.”

“I love people to know how their food is cooked rather than them just going to a yum cha where the food is just presented to them. I feel it helps you connect more to the food you eat.”

Cook Barbecue Pork with Enna

INGREDIENTS:

1 kg pork belly with skin off sliced into 3cm wide strips

Pork belly has a great fat to lean meat ratio but you can also use pork shoulder

1/2 cup soy sauce.

2 tbsp dark soy sauce

1/2 cup raw sugar

1/4 cup cooking wine

sprinkle of white pepper

1 tbsp salt is optional – add if you don’t have the luxury of an overnight marinade

BASTE:

1 tbsp oyster sauce

1 tbsp honey

METHOD:

*In a bag, place pork and add marinade sauce. Squeeze out excess air and make sure marinade covers meat then leave overnight if possible or for at least 8 hours (which was what I did in this video and photo)

*When ready to cook, heat oven to 180 C on fan forced

*Take meat out and bring to room temperature so it cooks evenly

*Place pork on a rack with a drip tray, then place in middle of oven. Cook for 15 minutes

*Take tray out then baste with the oyster sauce and honey marinade and place back in oven for 10 minutes

*Take tray out again, flip meat and then baste again. Place back in oven for a further 10 minutes

* Now it’s ready! Leave to rest for 5-10 minutes before serving

How to get 250K electric vehicles by 2025: Mark Gilbert of DriveElectric

What if I told you that former head of BMW in NZ now wants gas-guzzling, polluting cars off the road and replaced with low-emissions electric vehicles like the mild-mannered Nissan Leaf? A few years ago, I wouldn’t have believed it myself but Mark is now the chairman of Drive Electric, a consortium of interests from across the transport sector. They say electrifying the vehicle fleet is one of the most effective ways to achieve our goal of being carbon neutral by 2050. Their ambition is to make electric vehicle ownership mainstream and have 250000 EVs on the road by 2025.

Hear the Podcast Here:

About DriveElectric

Drive Electric is a not-for-profit with one goal – making electric vehicle ownership in New Zealand mainstream. Its members represent the full e-mobility ecosystem: finance, automotive, infrastructure, energy and government.

DriveElectric: https://driveelectric.org.nz/

Retail Investor Mania / Hamesh Sharma

Hoodies, onesies and jumpsuit investors may trump the suit and tie investors in the nice corner office. Hamesh Sharma from Pathfinder, joins me in a discussion around the rise of retail investor mania. Is it inevitable retail mania will end in tears, or is a fundamental shift in mainstream investing at play?

Hamesh Sharma is a Portfolio Manager at Pathfinder Asset Management

Retail investors — meaning regular people investing on behalf of themselves, not big institutions — are on the rise. According to one online investment platform, these Mum and Dad investors are now accounting for 25% of the share market, a number which looks to be steadily growing.

With wage subsidy money lining many accounts and sports gambling mostly out of order, Hamesh has watched in terror as these new retail investors emptied hard-earned savings into the likes of Air New Zealand, a company burning hundreds of millions of dollars with planes parked up at airports around the world with no border opening in sight. Why? Because the price has decreased and the government will surely bail them out – it must be a bargain!

It’s a pattern than many newer investors exhibit when they’re starting out. We can observe this when looking at companies like Hertz, which saw a stock price resurgence in the fourth quarter of their bankruptcy proceedings; Nikola Corp, a company with no product to sell even had a short spurt where it was valued higher than Ford; and Tesla, whose price jumped considerably upon announcing they’d be splitting their stocks, despite it having no material impact on the company’s value.

If you’ve been investing for a while, these signs and symptoms of mania should worry you. It seems to laugh in the face of reason, seen most absurdly in the popularity of BarStool Sports’ Davey Day Trader.

Markets should respond to logic — a company’s value should be proportionate to its fundamentals; earnings, track record, that kind of stuff. Miseducation among investors appears to be at an all-time high.

Then again, I can’t help but wonder, could these newer investors teach the status quo a thing or two about the world we’re heading into? Perhaps pure, illogical speculation in brand names is what ‘investing’ has been for a long time – maybe there’s not much of a difference between owning Bitcoin and Berkshire Hathaway?

Back to mainstream thinking though: Just because a stock that was once high is now low, doesn’t mean it’s a bargain. The markets aren’t stupid, and to assume they are is a sure-fire way to get your face ripped off. Sure, you’re going to find examples of companies that you see as being chronically undervalued by the market, but make sure you do your homework to understand their fundamentals before giving them your money.

We’re seeing plenty of little bubbles forming, nothing yet on the scale of the infamous dot com bubble of the nineties, but something very much worth keeping a watchful eye on.

Many Kiwi’s, myself included, have benefitted by having quality access to the markets, but education is vital to reduce the downside risks associated with providing access to all. Even if Davey Day Trader is right, and the ‘old fundamentals’ no longer apply, eventually the market will factor this in.

In today’s podcast, myself and Hamesh get real on this rise of retail investments, bubbles, irrational trading, investing vs gambling, and why, ultimately, more investors are really a good thing for the economy.

_________________________________________________________________

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

__________________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Tell your friends!

2- Write a review on Facebook, or your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage an authorised financial adviser to provide guidance around your specific goals and objectives.

_________________________________________________________

Money for Life / Liz Koh

Investing is a way to grow your wealth, but it can also just be a way to preserve your wealth so it’s available when you’re ready to spend it. Author and financial planner Liz Koh joins me to discuss the art of providing ‘Money for Life’.

What does retirement even mean in 2020?

As our lives get longer, and our careers span far beyond what generations before had, the lines are getting very blurry around when our retirement actually kicks off. It’s not so much that your working life has ended, it’s just going through a transition.

Retirement isn’t nearly as two dimensional as it gets credit for either. In fact, it takes many different shapes over the years where we transition from our professional life to our very last year — and each of these stages has different financial requirements.

Liz slices it up into three key stages which form a simple way to plan for the amount of money you’re going to need.

- The ‘live it up’ stage: You’re still fit enough to give life a good thrashing – just like right now, but with more time to spend on yourself.

- The ‘fix it up’ stage: You’re a little older, and perhaps not so keen to travel, but the house/hips/eyes really needs a bit of work.

- The ‘wind it down’ phase: We’re on to the final approach – here it’s about spending your last years exactly how you want.

Many believe that we’re ready for retirement when we have enough money invested that can generate sufficient returns without having to work — what I call the “nirvana of passive income”. It’s a tantalising thought, but when it sends us to the grave boasting a multi-million dollar empire that we barely touch, is that really success?

The older generation is still singing the passive income tune (it worked for them so why not?), but at some point, you need to do yourself a favour and smell the roses. Give yourself permission to spend the money you worked hard to accumulate. You can’t take it with you, your kids may not want it, and life really is short after all. Liz argues you’re better off taking the second cruise trip, in fact, while you’re at it, go ahead and tick every damn thing off your retirement bucket list as you can!

In this podcast, Liz and I dispel some of the myths around reverse equity mortgages, discuss the potential benefits of investing in a Lifetime income annuity, talk about the pros and cons to dealing with mortgages early, and help tie it all together with the example of a couple nearing retirement.

Reading:

- Reach out if you’d like a copy of Liz’s E-Book “Buckets of Money in Retirement”. Please email me on darcy.ungaro@nzeverydayinvestor.com to get your copy.

- https://www.lifetimeincome.co.nz/

- http://enrichretirement.com/

_________________________________________________________________

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

__________________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Tell your friends!

2- Write a review on Facebook, or your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage an authorised financial adviser to provide guidance around your specific goals and objectives.

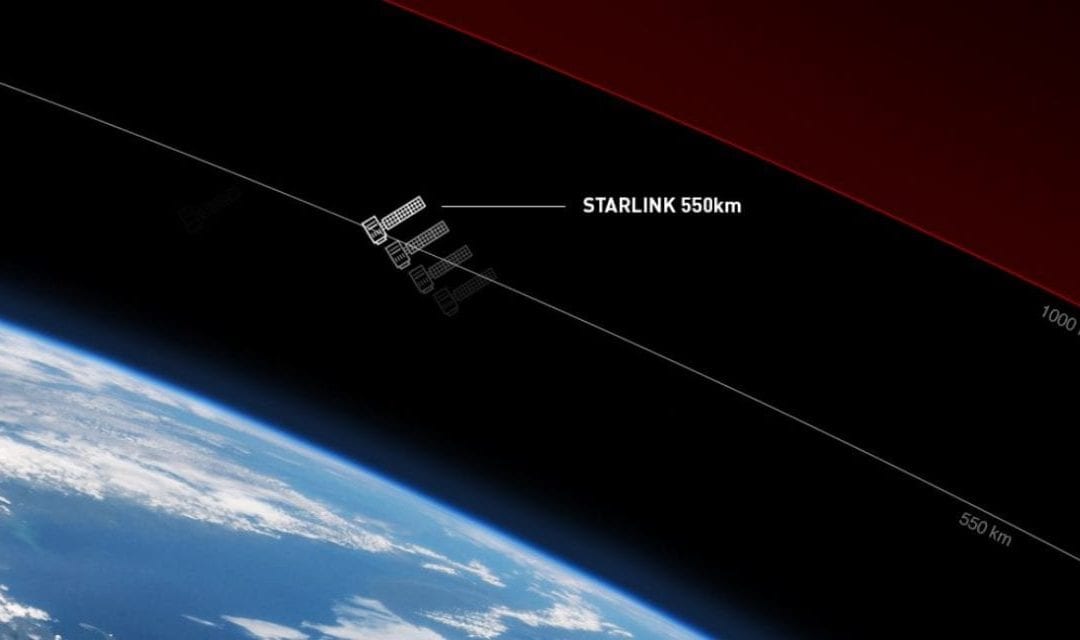

NZ HiTech Awards, NZX under attack, Apple’s Epic battle and Starlink broadband speeds

Brett Roberts joins Paul Spain to discuss the news of the week – including the New Zealand Stock Exchange’s current woes with Distributed Denial of Service (DDOS) attacks taking them offline. Is this a situation where blame can be put locally or is this entirely on cyber criminals trying to extort funds out the NZX?

Also, the valuable and inspiration role of the of the NZ HiTech Awards within New Zealand, Apple’s App Store fight with Fortnite maker Epic, Fitbit’s near wearable that hopes to help you recognise and address stressful situations, Tesla vs Modders and initial SpaceX Starlink satellite broadband speeds and latency are revealed.

Listen to the Podcast here:

NZ Tech Podcast

Paul Spain

Gorilla Technology

Free Tesla Supercharging

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Sumo Logic

HP

Samsung

Vodafone NZ

Spark NZ

Vocus

Foodprint: Cheap Meals, Less Waste

In New Zealand, cafes, restaurants and supermarkets produce 50,000 tonnes of food waste. Over 60% of this is completely avoidable. Michal Garvey is a big believer that, “Food that is grown for people should end up in people and not used for compost or fed to pigs or thrown in landfill”. This is why, she started Foodprint.

Foodprint is a food-tech startup that addresses the food wastage problem while providing win-win solutions for both eateries and consumers. Eateries list the products that they have a surplus of and make them available to users of the app at a discount. On the other side, customers can prepay and order their discounted meal and collect it from the café before they close.

Eateries benefit by having access to a database of new customers and a platform where they can minimise their food waste (and all the painful logistics associated with it) while recuperating some of their food cost. Customers benefit by discovering new eateries where they can buy tasty meals for a fraction of the price while playing an active role in tackling our society’s food waste problem.

On this episode we talk about:

- Having too much food and not enough customers at the end of the day, a real problem

- The logistical problems of food waste – donating it v/s throwing it away

- How Foodprint has evolved during lockdowns to help their eateries

- Food tech in NZ – a growing sector?

- Starting and scaling a food tech business, what it takes

Listen to the Podcast Here:

Quotes from the episode:

“My simplistic 16-year old thought why are we growing these crops to feed animals which we then eat when we could instead eat the crops myself.”

“Many eateries are quite good at using their sales data to predict how much food they should make. At the same time, there are so many variables that you never know what is going to actually happen. Eateries want to strike a balance between making sure you sell out and still having options for your last few customers of the day. That’s where Foodprint steps in.”

Download the Foodprint app on Apple Store or Google Play or learn more at www.foodprint.app

Added Bonus: Review our episode with Michal on Apple Podcasts or on the Kiwi Foodcast Facebook page and be in to win a $50 Foodprint voucher!

Hydrogen: hype, hope or happening? Andrew Clennett, Hiringa Energy

Hydrogen is a fantastic energy source: abundant, clean, light and highly flammable. But can it overcome its biggest hurdle: cost of production? Andrew Clennett, founder of Hiringa Energy, says an emphatic yes. Hiringa already has a green-hydrogen pilot plant in Taranaki (a JV with Balance Agri-Nutrients) and is rolling out truck fuelling sites across the country. And with trucking firms, vehicle manufacturers and the government (in part) already on board, Andrew says the biggest hurdle for hydrogen is not cost but Kiwi inertia. So we asked Andrew to explain the science, economics and his own journey from an oil man to a hydrogen hopeful.

Hear the Podcast Here:

About Andrew

Andrew is a Tasmanian and experienced energy executive, having spent 23 years as a drilling engineering and senior executive for Todd Energy, Woodside Energy and Maersk Oil. In 2017, he co-founded Hiringa along with finance executive (and his wife) Cathy and business partner and hydrogen expert Dan Kahn.

See Andrew, Cathy and Dan’s profiles here

About Hiringa

Hiringa is a Taranaki-based energy company specialising in hydrogen project development, hydrogen technologies, renewable power generation and fuel cell integration.

Michael Howard – Cyber Security Innovator

New Zealander Michael Howard has had a massive impact in reducing Cyber Security risk globally including convincing Microsoft Founder Bill Gates of the importance of secure coding – which lead to Gates famous company-wide memo on Trustworthy computing in January 2002. eWeek magazine selected Howard as one of “The 100 Most Influential People in IT”.

Hosted by Paul Spain and this week’s guest: Michael Howard

Listen to the Podcast here:

NZ Tech Podcast

Paul Spain

Gorilla Technology

Free Tesla Supercharging

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Sumo Logic

HP

Samsung

Vodafone NZ

Spark NZ

Vocus

Rescuing good food with Kiwi Harvest

Deborah Manning, Founder of Kiwi Harvest originally trained to be a lawyer. Her ‘aha’ moment for Kiwi Harvest came when she was looking for opportunities to make a difference in her community and read two articles. The first was of people living off the food thrown away in supermarket dumpsters while the second spoke of the huge food insecurity problem in New Zealand.

“It is estimated that New Zealand generates 103,000 tonnes of food waste annually and 60% of food going to landfill is actually edible. This avoidable food waste would feed between 50,000 – 80,000 people for a whole year and these figures are only of food wasted on the commercial side”, says Deborah.

Deborah decided to combine the problem of edible food being thrown away and used it to solve the problem of people not having enough food to eat.

Today, Kiwi Harvest operates in Auckland, Dunedin, Hawke’s Bay and Queenstown. They rescue food from all parts of the food chain from the grower to the retailers and rescue 170,000 to 200,000 kgs of good quality surplus food every month and diverts this back to people who are struggling with food poverty across New Zealand.

No food business wants to waste food, but most do not have the systems or networks required to find suitable new homes for their excess produce. KiwiHarvest provides businesses an easy solution for this problem while also working actively within communities to address our glaring food insecurity issues. Since they started in 2012, Kiwi Harvest has rescued 4.5 million kgs of food that was destined to be thrown away.

On this episode we talk about:

- How one man’s waste can be another’s treasure

- The meaning of food insecurity and the scale of the problem in New Zealand

- Why food insecurity leads to health issues within our communities

- The role of collaborations in growing a non-profit like Kiwi Harvest

Listen to the Podcast Here:

Quotes from the episode:

“One of the great things about food is that it is the great connector. It connects us to our culture, to our land and to people as sit and eat together”

“People are quite aware of why food is being wasted at the consumers’ end. But food is also wasted across the food chain for a variety of reasons like the grower has reached the quota of food they had to supply and so they don’t even harvest the food on the other paddock or because there has been a problem during manufacturing and the labelling in incorrect. It costs the manufacturer more to relabel this food than to simply dump it into landfill”.

“We had this enormous bulge of food when the hospitality industry shut due to the lockdown. Subway rang us and donated all their fresh vegetables that were stored in every store they have across the country and we had to figure out how we could distribute that across the country to those that really needed it.”

>> Get involved as a volunteer or fundraise for Kiwi Harvest: kiwiharvest.org.nz

Sun, Power and Todd Corp: The Story of Sunergise

The sun is the greatest source of free energy for the Earth – so why don’t we tap into it more? The team at Sunergise are changing that on an industrial scale. Sunergise is a Kiwi solar energy company that got its start in 2012 by building the world’s largest solar installation for a marina at Port Denarau in Fiji. Since then it has expanded across the Pacific and NZ and has just welcomed a major investment by Todd Generation, a subsidiary of Todd Corp, one NZ’s largest investment companies, famous for its oil and gas business. To talk about Todd, the journey to get here and the future of solar I was joined by directors Paul Makumbe (top left), Lachlan McPherson (middle) and Nick Worthington (right). I started by asking Paul just how the company began.

About Sunergise

Founded in 2012 as the first pan-Pacific solar power utility, Sunergise was started by a group of entrepreneurs and veteran investors including ANZ Oceania CEO Bob Lyon. Its mission is to secure a brighter, more productive future for the people of New Zealand and the Pacific Islands by providing high quality, clean, affordable energy. Increasing solar in the energy mix helps to reduce crippling fuel import bills and protect the natural environment that entices visitors from all over the world. In partnership with our customers, Sunergise is rapidly accelerating the adoption and installation of solar PV panels in the Pacific region. Its solar power creates energy independence and protection from rising oil prices. As part of developing a business with sustainability at its core, it aims to make clean energy affordable to all.

- Sunergise began operations with the introduction of the world’s largest installation for a marina at Port Denarau in Fiji.

- In 2014 The World Bank’s International Finance Corporation (IFC) took a stake in the business.

- The Sunergise group is the leading solar power services company in the Pacific Island region, with a growing portfolio of solar projects in Niue, Nauru, New Zealand, Fiji, Vanuatu, Marshall Islands, Papua New Guinea and Solomon Islands.

- In 2019 Todd Corporation via Todd Generation Limited took a majority stake in Sunergise New Zealand Limited and Sunergise International Limited.

- The investment will boost solar power generation in New Zealand and the Pacific Islands.

- To date over 13 MW of clean power has been installed and over 20 gigawatt-hours of electricity produced by Sunergise.

https://www.sunergisegroup.com/

Hear the Podcast Here:

About Sunergise

The Rise and The Risks of Night Trading / Ananish Chaudhuri

Professor Ananish Chaudhuri of the University of Auckland has made a career out of building games to test out economics theories. His most recent research looks into the impact of sleepiness on the behaviors of the growing class of ‘night traders’. Our podcast digs into trading, investing, the differences, and why, above all else, the most critical investment strategy is actually to have a strategy n the first place.

The Rise and The Risks of Night Trading

——————————————————

Professor Ananish Chaudhuri of the University of Auckland has made a career out of building games to test out economics theories. His most recent research looks into the impact of sleepiness on the behaviors of the growing class of ‘night traders’. Our podcast digs into trading, investing, the differences, and why, above all else, the most critical investment strategy is actually to have a strategy in the first place.

——————————————————

Would you consider it a good idea to hop behind the wheel with a few beers under your belt? What about trading stocks?

There’s plenty of evidence to show that drunk people are far more likely to underestimate the downside of a decision, which is a key reason why 16,000 New Zealanders still drink-drive every year. I sat down with Professor Ananish Chaudhuri from the University of Auckland to figure out why, and how these same risk management impairments people display when they’re inebriated, also extend to people who’re exhausted.

Years ago, Chaudhuri read a Forbes article looking into the rise of a particular new investor — the night trader. Armed with his understanding of how exhaustion impacts the likes of shift workers, he set out to learn whether people chugging red bulls late into the night trading stocks were ultimately doing themselves a disservice.

The resulting research, which asked uni students to trade at varying hours in the day (and night), had some intriguing results for a growing number of Kiwi traders.

“People who were sleepy made systematic mistakes,” said Chaudhuri. Even knowing how the game works, is not enough to inform participants well.

You would assume the old rule of thumb applies here – buy low and sell high. In reality, the opposite of this occurs. “They buy late in the game at high prices, and hold on to these stocks much later. So when the market crashes, they lose money.”

Not only that, but ‘alert people,’ those working at more optimal times, were intentionally taking advantage of the sleepy suckers.

One of the most interesting things to learn for investors reading about this study, is that it doesn’t make a difference if you’re playing with small or large sums of money. Even though the participants of the study were working with chump change, Chaudhuri says that risk taking habits with small sums are generally consistent when the same people are dealing with far bigger numbers.

Now this isn’t another safety announcement around what you should or should not allow your adult-children to do with their money. What we know is that there’s real value in what traders do (provides liquidity and price discovery etc). Some say trading can be a profitable exercise too (well at least at the start they say this). There’s two things I can say about this for certain about people who trade (and I include myself here!): They’re either going to get an expensive education or, they could lose money and end up just as dumb. As much as I don’t want people to lose money, I think there’s still more to be gained by investor experimentation than there is by staying away from trading.

_______________________________________________________________________

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

________________________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Tell your friends!

2- Write a review on Facebook, or your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage an authorised financial adviser to provide guidance around your specific goals and objectives.

_____________________________________________________________________________

Has organic food gone mainstream?

Pablo Kraus is CEO of NZ owned and operated, Chantal Organics. Chantal Organics started as a family run food co-op over 40 years ago in 1978 when a group of families came together to buy natural wholefoods in bulk. This eventually turned into a shop and today, Chantal Organics is a nationwide manufacturer and wholesaler, distributing organic products into grocery and health food stores around the country from their facility in Hawke’s Bay.

Supermarkets today are stocking a growing range of organic products and it feels like as a population we are getting more curious about where our food comes from. However, as Pablo says, “We have a really long way to go and part of the challenge will be to address through education. Education about what organic farming is and education about what actually is in the food we eat”.

On this episode we talk about:

- Has the landscape for organic food in NZ changed?

- How organic is the organic food we are eating?

- Why is organic food so expensive? What can we do to make it more accessible?

- Perfectly formed fruits and vegetables come at a price and drives up the cost of organic produce

- How does eating organic food help save our land and water

Listen to the Podcast Here:

Quotes from the episode:

“People start to become hyper aware of what they are eating when they get sick. More and more people are thinking I don’t want to get to that stage and so we start thinking about what we are putting into our bodies.”

“When I think back to why Chantal Organics was setup, it was setup as a co-op to make it affordable for families to be able to buy organic products.”

“Children today are not aware of where food comes from. Where does a carrot come from for example? When we are growing produce at home, even if it’s just chilies and herbs, our kids can go outside and pick the fruits and vegetables and understand the work it took to grow the food we eat. The food we grow in our gardens also just naturally happens to be organic as we don’t really spray it with chemicals.”

Learn more about Chantal Organics product range or explore their recipes on www.chantalorganics.co.nz