Paul Donaldson – Pegasus Bay

The Donaldson family have been immersed in the wine industry since the early 1970s and were pioneers of grape growing and wine making in Waipara, North Canterbury.

Youngest son Paul shares how it was growing up in the wine business to now being an active member of the winery which remains in the family.

(Recorded on Zoom – apologies for echo)

Listen to the Podcast Here:

www.pegasusbay.com

www.nzwinepodcast.com

www.instagram.com/nzwinepodcast

Music track featured on this podcast: ‘Here He Was’ – courtesy of Brent Page. Dog Squad Music

This episode is brought to you with thanks to:

– Let’s get your business started!

The Art of Caddying with Steve Williams

The world’s best known golf caddy, Steve Williams, voices his opinion on the PGA Tour’s proposed use of distance finders that, in theory, would take away the traditional role of caddies from stepping off distances and generally doing the work golf caddies are known to do.

Listen now:

Nathan White – Ripe, The Wanaka Wine & Food Festival

Sunday March 21, 2021 will see the inaugural Ripe, Wine & Food Festival in Wanaka. The founder and organiser Nathan White tells us how it came about and who’ll be there.

List of Wineries with the relevant NZ Wine podcast episode # for the ones we’ve spoken with previously:

- Aitkens Folly, Akarua, Amisfield, Aurum episode #30,

- Black Peak, Burn Cottage episode #41,

- Cloudy Bay, Coal Pit, Dicey, Domain Thompson, Maude, Misha’s episode #60,

- Maori Point, Mount Michael episode #34,

- Nanny Goat, Paddons Paddock, Quartz Reef, Valli episode #25

Listen to the Podcast Here:

Get tickets at: www.ripewanaka.nz

www.nzwinepodcast.com

www.instagram.com/nzwinepodcast

Music track featured on this podcast: ‘Here He Was’ – courtesy of Brent Page. Dog Squad Music

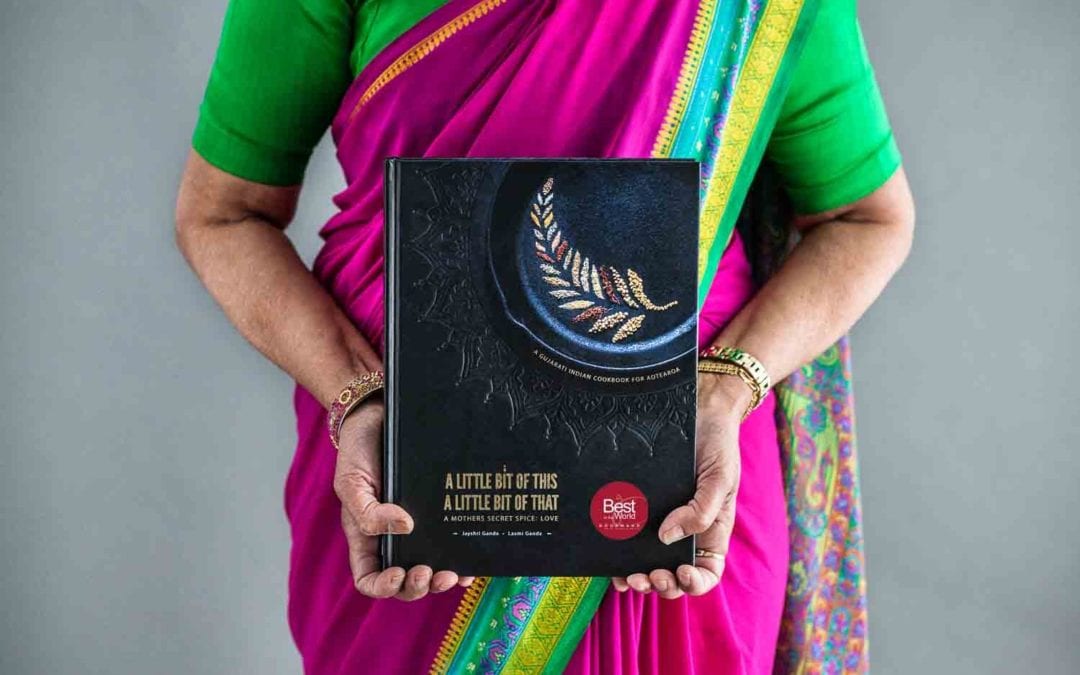

A little bit of this and a little bit of that

Jayshri was born in New Zealand. However, she grew up eating primarily Gujarati food at home. For her mum, like many Indian mums, food was the primary love language. Jayshri didn’t learn how to cook Indian food until she left home to study. She would try calling her mum to ask her how to cook something and would often be told to add ‘a little bit of this and a little bit of that’.

It’s a quandary many of us have faced. Not wanting her family secrets to be lost, Jayshri started noting the recipes down in a wee notebook when her parents sold the family dairy. However, when she told a few Kiwi friends what she was doing, they all said, “oh my God, we need it because our mums are the same”. The project turned into a cookbook that Jayshri has self-published with her mum and the duo’s book won the Best in the World Gourmand Cookbook Award in 2018.

On the episode we talk about:

- Intuition, a key ingredient for cooking Indian food

- Food, the recurring theme in Indian culture

- New to cooking Indian food? Here are the key fundamentals

- Self-publishing a cookbook, why do it

Listen to the Podcast Here:

My favourite quotes from the episode:

“Back in the 80s when I went to school, we were the only Indians in my school at Christchurch. Back then no one knew about Indian food. They didn’t even know what a samosa was.”

“My mum was used to just cook with her own teaspoon she had in her home. So she would use her spoon, then we would tip it into the measuring spoon and that’s how we figured out the recipes.”

“You walk into an Indian household and straightaway they are sharing food with you.”

The future of transport is small – Micromobility co-founder Oliver Bruce

Climate change sucks, but there are some upsides. Electric skateboards being one. E-scooters being the other. In fact the whole micromobility revolution is so much fun. And no one is having more fun than Oliver Bruce, the ex-Uber exec who has returned to NZ to become an angel investor and agitator for micromobility in our cities. Oliver is the co-founder of the Micromobility.io – a conference, podcast and research group focused on the future of short-run, urban transport solutions that don’t kill the planet. Micromobility.io is in itself a new breed of digital companies with the founders living in Helsinki, Wellington, New York and San Francisco. Why the hell not? The earth is flat, especially when you on an e-bike right?

Hear the Podcast Here:

Visit Micromobility here

About Oliver

Oliver Bruce is an angel investor and co-host of the Micromobility Podcast with Horace Dediu. Previously, he was with Uber in Australia and New Zealand working on strategic projects and business development. He lives in Wellington, New Zealand.

Personal Finance Series: Love and Money

Catherine Emerson and Donna Robinson help me in this week’s episode to unpack all that is love and money

Love and Money – at least one of these two things elude at some stage. Before you invest, you’d do well to get the basic money management stuff sorted out.If there is a significant other, make sure you’re working together if you can before you make any serious money moves.

Our first guest is Donna Robinson, who works with the team at Sorted. Next up, I have Catherine Emerson, former financial adviser, who works with Kernel Wealth.

Today, the goal is to discuss some of the reason’s why there can be conflict in a relationship with respect to money, and most importantly, how we can turn a weakness into a strength when financial consensus can be achieved at home.

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

____________________________________________________________

The NZ Everyday Investor would also like to acknowledge the support of kōura.

Most people fixate on just fees or historical returns when trying to choose a KiwiSaver fund. But professionals know there’s the third, arguably more essential component to consider – asset allocation. kōura’s digital advice tools will build you a KiwiSaver portfolio that has the perfect asset allocation just for you. Of course you could also just choose your own KiwiSaver portfolio with them too. Give them a try and see what your ideal KiwiSaver asset allocation looks like for you.

___________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Tell your friends!

2- Write a review on Facebook, or your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage a financial adviser to provide guidance around your specific goals and objectives.

_____________________________________________________________________________

A food factory like no other!

The FoodBowl is for food entrepreneurs what the Willy Wonka Chocolate factory was for kids. Supported by Callaghan Innovation and run by the Auckland chapter of the NZ Food Innovation Network, the FoodBowl is an open access facility whose core business is to increase the value of New Zealand’s food sector by encouraging companies to develop and commercialise new products.

We all know that developing a new product or process can be an exciting journey. But it’s also exhausting. FoodBowl provides support and resource for companies and innovators not only with expert advice and connections to experts but also with access to a huge range of equipment. While the facility and therefore the manufacturing runs are partially funded by the tax-payer, all companies pay to use the FoodBowl. Whether you’re looking to make something cheaper, faster, safer or better or you’re ready to grow beyond Kiwi shores, the FoodBowl can help.

Businesses like Pure Food Co. have used their facility to commercialise their product before investing in a plant while established companies like Sanford Ltd have used FoodBowl’s equipment and importantly, engineers to fast-track their research in fish oils, mussel extracts and proteins.

“We are a bridge between a kitchen recipe and a contract manufacturer”, explains Alasdair Baxter, Business Development Manager at FoodBowl. On this episode, I talk to Alasdair to find out:

- What exactly is the FoodBowl and how they help food innovators

- Is the FoodBowl right for your business?

- How innovative do you need to be to secure support from the FoodBowl

- Culley’s, Citizen and The Apple Press, how the FoodBowl has helped these Kiwi companies

Listen to the Podcast Here:

America’s Cup Innovation – Tim Meldrum (Emirates Team NZ), Oliver Hill (HP)

What happens behind the scenes from a technology and innovation perspective to help Emirates Team NZ compete on the world stage? NZ Tech Podcast talks with Emirates Team NZ Designer Tim Meldrum and HP NZ General Manger Oliver Hill.

I want to give a huge thank you to NZ Tech Podcast partners – including Vocus, Vodafone, Spark, HP, Gorilla Technology, and Umbrellar Connect.

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Sumo Logic

Vodafone NZ

HP

Spark NZ

Vocus

Gorilla Technology

NZ Sales and Marketing Insider – Episode 4: Richard Conway

The Death of Oreti Sands

Oreti Sands, a links course at the very bottom of the South Island, often called “the southern most golf course in the world” and one highly praised by both domestic and international golf writers, closed for good two years ago. After various attempts to re-open, the club is no more. Our hosts talk to Andy Fraser, a former member and one of the last remaining volunteers, to find out what happened.

Listen now:

Is He Happy Now? James Shaw on the Climate Change Commission and COP26

As the co-leader of the NZ Greens and the minister for Climate Change, James Shaw has defied his critics to get climate change on the government agenda with the overhaul of the Emissions Trading Scheme, cross-party support for the Zero Carbon Act, and the creation of the Climate Change Commission who’s daft report has just been published. All wins for sure but wins that feel about a decade too old and still too early to change NZ’s love affair with V8 utes, motorways and dairy herds. Is he satistifed with the Comission’s report? What will he bring to the table at the COP26 in Glasgow this year and has he overcome his mother’s threat to throw himout of the house if he ever got into politics?

Hear the Podcast Here:

Its super shiok la!

Adlena Wong grew up in Singapore. Her mix of Chinese, Indonesian and Malaysian heritage meant that she grew up eating a lot of sambal and dodo’s (a sticky taffy like pudding) as well as having Tau Huay (soy bean pudding sweetened with ginger and vanilla) for breakfast every weekend at the local hawker stall with her grandmum.

At the end of 2020, Singapore hawker culture was added to UNESCO’s Representative List of the Intangible Cultural Heritage of Humanity. A whole generation of Singaporean bankers, lawyers, engineers and more have had their studies funded by their parents’ hawker stalls. Each stall often sells only one or two items that they are known for and its where the country’s best food can be found!

Adlena moved to New Zealand in 2019. When she was unable to find a job after a year of applying unsuccessfully for jobs she decided to follow her love of cooking and started Super Shiok Eats, a home-based takeout in Auckland selling Singapore street food through Facebook. She started with selling the iconic nasi lemak, a coconut rice dish served with spicy chilli sauce, sambal which is an all-day meal in Singapore. Since then she’s done a Singapore chilli crab special and made Auckland’s first Bak Chor Mee, a noodle soup served with ground meat. The menu changes daily depending on what Adlena feels like making. Today, she sells about 30 to 40 boxes of nasi lemak a day and has even catered for a Christmas party for 250 people, entirely cooked by herself in her home kitchen!

On the episode we talk about:

- What does ‘shiok’ even mean?

- Food vendors in the Asian subcontinent and their 10000 hours of expertise

- Singapore noodles

- Why you will never find them in Singapore

- Is there such a thing as Singaporean food?

- The Super Shiok Eats journey

Listen to the Podcast Here:

Photo Credit: Dean Purcell – NZ Herald