The Sanctuary Mahi Whenua Community Garden: Trevor Crosby

In the heart of Mt Albert, Auckland, is one of the oldest gardens in NZ. The Sanctuary Mahi Whenua Community Garden was first planted by Maori in pre-European times and hasn’t been built on since. The vege gardens and food forest have been lovingly cared for over the years and flourished under the ownership of Carrington tech, now Unitec. But they face an uncertain future following the sale of the lands to Housing NZ. Despite assurances, the gardens remain zoned for residential development. Vincent is on a break this week so handed the reigns to writer and sustainability advisor Sarah Heeringa to interview gardens curator Trevor Crosby.

This podcast first appeared at The Feed Weekly.

Hear the Podcast Here:

NZ Sales & Marketing Insider – Episode 11: Richard Johnston

“It was the collection of failures that led to my ultimate success” – Richard Johnston, co-CEO of TripADeal, an online travel booking engine topping the Australian Financial Review Fast 100 List two years in a row and a growing annual revenue of 40% pre-covid. In this episode, Ben speaks to Richard Johnston about his “out of the mold” career path, what it means to have an entrepreneurial spirit and TripADeal’s simplified approach to media buying, which led to its success.

Listen or Subscribe Free:

How is Golf NZ Promoting Participation?

Our hosts talk to Thiem Nguyen, Manager of Participation for Golf New Zealand about the new ways in which the lead organisation for the sport in this country is working to be more inclusive and raise the number of people playing the game casually and as members of a club.

Listen now:

Women in Tech Panel: Sarah Webb, Amelia Gain, Alliv Samson

In this episode Paul Spain is joined by three outstanding leaders – Sarah Webb: COO at LawVu, Amelia Gain: CEO & Co-Founder at Preno and Alliv Samson: Co-Founder at Kami. Each has a natural affiliation to tech and have garnered years of experience in tech and leadership. We discuss their challenges in leading and establishing a startup, hiring and diversity, business confidence and inspiring more representation for women to be encouraged to enter and to lead in business and tech.

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Vodafone NZ

HP

Spark NZ

Vocus

Gorilla Cyber Security

Datacom

Palo Alto Networks

Stefan Powell: CTO & Co Founder – Dawn Aerospace

Paul Spain sits down with Stefan Powell of Dawn Aerospace to learn a little of what it takes to establish a new space startup in New Zealand. Stefan delves into a wide range of topics including the Aurora Spaceplane.

Listen to the Podcast Here:

Show Links:

Gorilla Technology

Paul Spain – LinkedIn

Paul Spain – CEO, Business & Tech Commentator, Futurist

You can keep current with our latest NZ Business Podcast updates via Twitter @NZ_Business, the NZ Business Podcast website.

The Responsible Investor / Ep 162

Rupert Carlyon from Koura Wealth, a KiwiSaver fund manager who states on their website, that they invest ‘according to a set of environmental social and governance principles (ESG) wherever possible’. even do a little good.

Socially responsible investing, ESG, ethical investing – these principles are nothing new, but today we’re going to run through what Koura does in order to do no harm, and dare I say, even do a little good, when investors play the game.

We’re in a season of expecting more from our investment activities – not just in the form of higher returns with lower risks, but with lower levels of social and environmental harm especially.

ESG or socially responsible investing is awesome, but I think it’s a poor substitute for actually doing good yourself. As an investor, you’re capable as a person to do far more good simply by paying more tax, giving generously and consistently, and disrupting your workplace.

Hope you enjoy the show!

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

____________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Follow @darcyungaro on Clubhouse.

2- Write a review on Facebook, or on your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage a financial adviser to provide guidance around your specific goals and objectives.

If you would like to enquire around working with Darcy (financial adviser), you can schedule in a free 15 min conversation just click on this link

_____________________________________________________________________________

NZ food done like it should be: The Chia Sisters

The Chia Sisters is the kind of food company we dream of in New Zealand. Lovingly created by a family business and bottled in a solar-powered factory, this healthy energy drink is delicious, premium, and wholly sourced from local ingredients. The company is certified carbon positive, pays its workers a living wage, and is a founding member of Future Foods Aotearoa, a network of pioneering food companies that’s making the ‘volume to value’ story a reality. Is it too good to be true? Vincent spoke to founders, sisters Florence and Chloe van Dyke, about their vision for a different kind of food company and just how ambitious a sustainable operation like this can be.

Hear the Podcast Here:

Chia Sisters, New Zealand: https://www.chia.co.nz/

Making the keto lifestyle easy

Julie Gillingham was a dental hygienist when she fell in love with the keto lifestyle. After giving birth to two children, she loved how keto made her feel. The sleep was better, she had more energy and of course, the weight loss was a bonus. She did miss eating ice cream though. And pizza!

“When my family was following keto strictly, we would have pizza once a week but could never find a pizza base that was both tasty and affordable.” So she decided to try making them herself. Julie had hit on the right pain point because anyone doing keto knows that giving up bread is the hardest bit. Not because of its doughy goodness but rather because you need a ‘base’ for the food you cook or to mop up that curry.

Julie eventually traded in her mask and scrubs for an apron & chefs cap to pursue her dream of running and growing Keto Smart Bakes full time. The range of products she offers has continued to expand from pizza bases to bagels, tortillas and garlic bread, with more to come!

The unique thing about Keto Smart Bakes is that everything is made in small batches, hand-crafted and freshly baked weekly. “I work on a pre-order basis and that can be a bit challenging for new customers because we live in such an instantaneous world. But my customers know that I am a solopreneur and that I’m also a mom. They know that I put so much into my business and my products that it’s worth the wait.”

Specifically, we chat about:

- As a small business owner, finding the balance between work life and home life

- Working around production challenges when everything is hand-crafted

- Making ‘convenience’ products that are still worth the wait

Listen to the Podcast Here:

Favourite quotes:

“I’ve had people come and ask me are you even a business because every time they try to pre-order we have already sold out.”

“I was creating the things that people were missing. BLT’s, pizza, bagels, people miss eating those on keto and they don’t always enjoy baking those themselves. If you can buy these products then it makes eating keto easier.”

“People keep coming back because of the quality. Everything is made in small batches. I hand roll the bagels. I’m not a huge factory but rather one person that’s trying to make a difference.”

News of The Money-World / Ep 8 / Investing in TLA’s

Welcome to a short bonus series in addition to our weekly show. In partnership with Koura Wealth, your digital KiwiSaver provider, The NZ Everyday Investor is proud to present, News of The Money-World, a short, fortnightly show, about what’s happening in the finance world and how that affects you, the everyday Kiwi.

TLA’s, or three letter acronyms: a subconscious moat of defense we collectively lay down when we need to own the support of others. In your profession, your circle of friends, your flavor of politics, you’ll have your own language, and you may not even know you’re excluding others by default. The finance industry does this also – so today, we’re going to break some of them down and discuss what we think they mean

Rupert Carlyon from koura wealth KiwiSaver is my co-host, along with Tom Botica, from Investing with Tom.

Julian McCormack, Ep 160, Know the Ledge

‘Living on shaky grounds too close to the edge, let’s see if I know the ledge’ – Eric B and Rakim. We’re having a discussion today around the share markets, inflation, trends, and how to think about investing with the level of caution required for today’s world.

My guest today: Julian McCormack from Platinum Asset Management

Building wealth is about owning the right to have choice in the future – choices for you and for what’s important to you. Investing, or the practice of putting skin in a game where the odds are increasingly stacked in your favour over time, can often invoke emotions in us that we mistakenly thought we’ve already mastered. When the rubber hits the road and your hard-earned dollars are invested, logically, you want to understand the environment in which your dollars are at play in.

This environment is in a constant state of change. So today, let’s talk about that – enjoy!

Disclaimer: Platinum Investment Management Limited ABN 25 063 565 006, AFSL 221935, trading as Platinum Asset Management: Commentary reflects Platinum’s views and beliefs at the time of recording, which are subject to change without notice. Certain information contained herein constitutes “forward-looking statements”. Due to various risks and uncertainties, actual events or results, may differ materially and no undue reliance should be placed on those forward-looking statements. To the extent permitted by law, no liability is accepted by Platinum for any loss or damage as a result of any reliance on the information contained herein. Information is general in nature and does not take into account your specific needs or circumstances. You should consider your own financial position, objectives and requirements and seek professional financial advice before making any financial decisions. You should also read the latest relevant product disclosure statement before making any decision to acquire units in any of Platinum’s funds, copies are available at www.platinum.com.au

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

____________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Follow @darcyungaro on Clubhouse.

2- Write a review on Facebook, or on your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage a financial adviser to provide guidance around your specific goals and objectives.

If you would like to enquire around working with Darcy (financial adviser), you can schedule in a free 15 min conversation just click on this link

_____________________________________________________________________________

News of The Money-World / Ep 7 / RBNZ Playing Chicken with Inflation?

Welcome to a short bonus series in addition to our weekly show. In partnership with Koura Wealth, your digital KiwiSaver provider, The NZ Everyday Investor is proud to present, News of The Money-World, a short, weekly show, about what’s happening in the finance world and how that affects you, the everyday Kiwi.

Has inflation arrived in earnest, has it moved in, or is it that one friend who visits from time to time simply to burp in the fan on a hot day?

It’s an odd world we live in where the enemy of the economy, inflation, is being pursued like a purse- snatcher down a dark alley. You really don’t want to catch it, but you feel a perverse need to chase and obtain what you’ve likely lost ages ago.

More and more of us are starting to believe inflation is here however. Oddly, the more people think it’s here, the more likely it could get worse – perhaps we should label inflation-talk as hate speech to be safe?

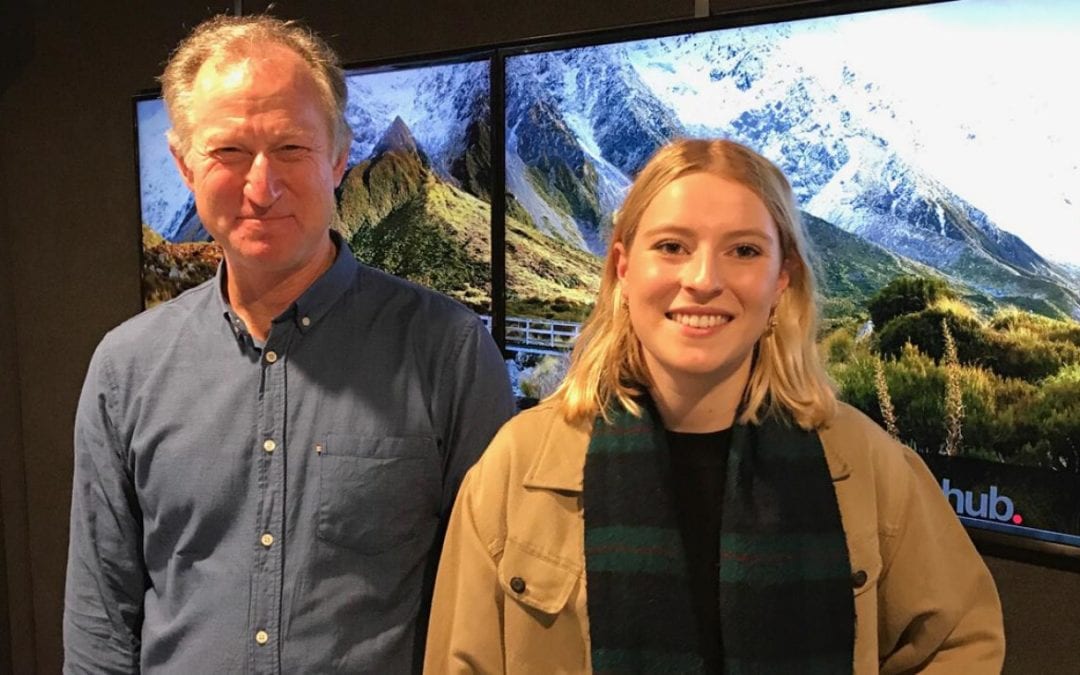

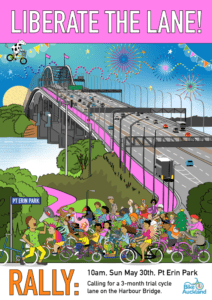

#Liberatethelane! The Auckland Harbour Bridge Protest with David & Mary-Margaret Slack

Last Sunday a remarkable thing happened. Along with 2000 of my best friends I rode over the Auckland harbour bridge on my bicycle. I was surpirsed how gentle the gradient was and how pitted the tar-seal surface is. The views are some of the best in Auckland. The really surprising thing though is that were doing it all. The last time someone rode over the bridge is 12 years ago – also a protest at the lack of cycling access to the shore. 12 years later we still have nothing on offer excpet crowded ferries. The situation so riled my next guests that they decided to act, creating – along with BikeAuckland – the Reclaimthelane rally and protest. I’m joined by Mary-Margaret Slack, a comms manager at BikeAuckland and her dad, David Slack, writer and inveterate cycling enthusiast.

Hear the Podcast Here:

See more about LiberateTheLane here

See the lovely picture of Mary-Margaret at the 2009 protest in David’s superb article here

Check out here this amazing climb-down from anti-cycling objectors in Vancouver when a bike lane was introduced to their harbour bridge. They now want two!