How to Design a Golf Course

Greg Turner, once New Zealand’s best player on the European PGA Tour, has become New Zealand’s foremost golf course designer whose projects include the expansion of Millbrook Resort into a stunning 27-hole layout. He talks to Brendan Telfer about his design approach and what it takes to build a beautiful golf course for all handicappers.

Listen now:

Crafting premium New Zealand honey

Unlike a lot of food companies that start with the goal of conquering the local NZ market, Zealandia Honey was born out of international demand for premium, native New Zealand honey. Co-founders Sri Govindaraju, Sunil Pinnamaneni and Robin de Gues are passionate about honey and believe that people can benefit not only from Mānuka honey but other types of New Zealand native honeys because of their high antioxidant and polyphenol content.

Zealandia don’t make their own honey. Instead, they collaborate with beekeepers across New Zealand, most of whom have been beekeeping for generations. Zealandia then tests all the honey at their ISO17025 certified laboratories where they test the quality, potency, authenticity and purity of the honey.

“In the right conditions, honey can be matured like a whiskey or a fine wine. The amount of methylglyoxal (MGO) in the honey will increase. However, there are about 50 different variables that must all be exactly right, honey with a high MGO count is rarely harvested”, says Sunil.

When Zealandia Honey was offered a high MGO honey for sale, they jumped at the chance. They then bottled this honey and created a batch of 120 bespoke jars, selling each for $3100.

On the episode we talk about their high growth journey. Specifically, we talk about:

- Creating a product that’s primarily targeted to export markets

- What makes Manuka honey special

- Identifying a great honey – UMF or MGO?

- Why is honey testing important?

- Is there a market for a $3000 jar of honey?

Listen to the Podcast Here:

China vs U.S. tech, NZ’s broadband lead and PS5 vs Xbox

Paul Spain and Bill Bennett discuss the tech news of the week including talking about Hyperfibre, Apple, Microsoft, Huawei and more.

Listen to the Podcast here:

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Sumo Logic

HP

Samsung

Vodafone NZ

Spark NZ

Vocus

Gorilla Technology

Talking Internet of Things (IoT) and 5G with Vodafone’s James Moore

In this episode of NZ Tech Podcast, Vodafone’s James Moore joins Paul Spain to discuss the Internet of Things (IoT) and 5G.

Listen to the Podcast here:

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Sumo Logic

HP

Samsung

Vodafone NZ

Spark NZ

Vocus

Gorilla Technology

How to Stop Owning a Stupid Metal Box: Erik Zydervelt, Mevo

Are you sick of owning an expensive, polluting metal box called a car? Me too. Mine sits in the garage taking up real estate and costing me bomb in maintenance and registeration. Is car sharing a better alternative? The idea is simple: use an app to pick up one of the share cars dotted around your city, do your thing, park it and walk away. Voila! Maybe. Car-sharing has a long and painful history. The first scheme was started in 1948, and since the 2000s there have been dozens of start-ups around the world. Mevo, a car sharing scheme based in Wellington, is the latest to give it a crack. Vincent was joined by co-founder Erik Zydervelt to explain his vision for reducing emissions, solving gridlock and why this time car-sharing will finally succeed.

Hear the Podcast Here:

Google Antitrust, Chinese Uber competitor arrives + Death of a Disruptor?

Sarah Putt and Paul Spain discuss the Google Antitrust case, DiDi the Chinese Uber competitor arrives, Quibi – the Death of a Disruptor, iPhone 12 hands on and more.

Listen to the Podcast here:

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Sumo Logic

HP

Samsung

Vodafone NZ

Spark NZ

Vocus

Gorilla Technology

Magic of The First Table

Inspiration for First Table sparked when Mat Weir discovered a new approach to dining that he’d never come across before. Tucked away in Queenstown, New Zealand, was a small French restaurant offering 50% off their first table of the night. By discounting the ‘first table’ the restaurant could build a great atmosphere from the start of service which in turn attracted more customers.

For Mat and his family, having the discount meant they could sample daring local delicacies and a good bottle of wine, without breaking the bank.

Already a tech entrepreneur, Mat saw an opportunity to build an online marketplace to solve the problem of slow starts to evenings, at scale.

In September 2014 he launched First Table with ten restaurants in Queenstown. He then set off in a relocation campervan, driving from Christchurch to Auckland pitching to restaurants along the way. By day, he’d meet with restaurant owners, and by night, he’d drive to the next city. Fast-forward to today, restaurants and diners are using First Table in over 50 cities around the globe.

On our episode we talk about:

- The First Table business model and why it’s a win-win

- Getting those first customers and doing whatever it takes

- Running a startup in Queenstown, what’s that like

- What it really took to launch into international markets

- Challenges of scaling continuously

Listen to the Podcast Here:

Quotes from the episode:

“Empty tables don’t make money. If we can put people into those tables that’s incremental revenue for the restaurant. People also don’t like going into an empty restaurant. So if you can fill those empty tables at the beginning of the night it get’s everyone’s night off to a great start!”

“Getting those first customers was tricky. As a tech entrepreneur I had spent most of my life sitting behind a computer not talking to anyone. At first, I tried getting others to do the selling but that didn’t work. I realized I was the one that knew the most about First Table and what we were trying to achieve so I had to suck it up and do the talking myself. It was hard to do but restaurants were really interested in this new approach.”

Claire Allan – Huia Vineyards

Claire spent her childhood in North Canterbury in the South Island, (Te Wai Pounamu) and after studying winemaking at Roseworthy in Adelaide, Australia she returned to Marlborough to embark on her winemaking career.

Listen to the Podcast Here:

![]()

![]()

![]()

![]()

Episode Links:

Huia Vineyards – https://www.huiavineyards.com/about-huia/claire-mike-allan

www.nzwinepodcast.com

www.instagram.com/nzwinepodcast

Music track featured on this podcast: ‘Here He Was’ – courtesy of Brent Page. Dog Squad Music

Thanks to www.bizebu.com Let’s get your business started!

Should we fear the coming zombie-company apocalypse? Sharon Zollner

Rise of the walking dead: Should we fear the coming zombie company apocalypse?

On many street corners this Halloween, you’ll spot zombies stiff with rigor mortis ambling about the streets in search of human flesh, another place to drink, or a bowl of sweets.

As most people know, a bad run in with a zombie can be fatal and ideally should be avoided at all costs.

While many people believe zombies to be the thing of myth, legend, and Halloween dress-up games, chances are you might have more to do with them than you’d think. Heck, you may own shares in one.

So here comes the term “zombie company” — an organisation stumbling around, unwashed and potentially beyond its use-by date, desperately looking to devour more debt.

“The basic idea is that it’s a company that’s really not doing well enough to survive in normal times, if money wasn’t free,” said Sharon Zollner, ANZ’s chief economist who joined me on the latest NZ Everyday Investor Podcast.

The wage subsidy, which indiscriminately emptied money into all kinds of businesses throughout the country, has allowed many firms to live out past their expected life span. Interest rates, which are getting dangerously close to negative territory, makes debt cheaper than ever. These two factors culminate in the perfect storm for the undead.

How to identify a zombie company

For investors, particularly more fresh-faced retail ones, the obvious question is how to spot these zombie companies. Unlike the dressed up zombies lurching around town this weekend, there aren’t a million giveaways, just one big one; debt.

First, you need to understand how much debt a firm is carrying, then, what it’s used for. Is it debt toward innovation, or debt just to keep their heads above board?

Then, you need to understand if they’re generating sufficient cash to not only cover costs and interest charges, but to repay the debt itself. If they’re on debt – life support, you may wish to start running.

Some of the lowest interest rates ever are responsible for creating these zombie firms. In the United States for example, we’ve been seeing a record number of investors piling into assets aptly known as ‘junk bonds’ in the hunt for a better yield. These high risk, high reward securities are issued by companies who run a strong likelihood of not being able to pay it back. This ‘toxic debt’ is offloaded often to people still clinging to the paradigm of ‘living off interest’. This may end poorly.

Are they worth keeping alive?

Historically in New Zealand, we’ve seen a natural inclination from policy makers to keep these debt-ridden companies alive. The art is in not allowing them to all hit the wall at once. In the medium to longer term however, it’s not a good thing to allow in our economy.

“The cost of them failing can be measured, but the cost of firms never starting up because those incumbents are sucking up the resources, that cost is unmeasurable; but it’s real,” said Zollner.

If I was to go zombie hunting here in New Zealand, I’d probably start in our tourism sector. When our borders closed, we watched an entire industry come to grips with a serious oversupply issue. There’s no way that excitable Aucklanders could ever make up for the shortfall of international visitors we would usually expect over our peak summer months.

In an efficient, free and productive market, companies should be allowed to die out. With death, we allow for other companies to grow in their place – it’s survival of the fittest and yes, it’s unpleasant. To avoid mass unemployment, I’d be hard-pressed to criticise the way the Reserve Bank has responded initially to this crisis, but at some stage, we do need to call the funeral director. This is the ‘we-can-still-be-friends’ method of breaking up with inefficient business.

What could a mass cull mean for everyone?

Debt is cheap as chips, wage subsidies have mostly run their course but have given millions to an unproductive section of the economy. The greatest fear now is that all of these zombies will all meet their maker at once.

“If we saw a sustained rise of inflation, we’d see a rise in interest rates, no matter what the banks do. Either way, zombies could all hit the wall at the same time,” said Zollner.

And this is where I’m scratching my head – what happens if/when interest rates increase? If money is cheap, and made readily available, it makes sense to take advantage of this as a firm and as an individual, especially when low rates seem to be highly correlated to rising asset prices. So I can only really see a few possibilities here: We’re either going to have a massive amount of defaults, or reliance on the sale of assets to reduce debt, or we’re going to see a transition into an alternative monetary system where a central bank digital currency replaces our debt-based money.

The forces of creative-destruction should be left to play out – but this time, due to the synchronised nature of the situation we now find ourselves in, what’s more valuable: Allowing for the efficient re-allocation of capital, or allowing businesses and employees time for a safe transition?

_________________________________________________________________

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

__________________________________________________________________

The NZ Everyday Investor would also like to acknowledge the support of kōura.

Most people fixate on just fees or historical returns when trying to choose a KiwiSaver fund. But professionals know there’s the third, arguably more essential component to consider – asset allocation. kōura’s digital advice tools will build you a KiwiSaver portfolio that has the perfect asset allocation just for you. Of course you could also just choose your own KiwiSaver portfolio with them too. Give them a try and see what your ideal KiwiSaver asset allocation looks like for you.

___________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Tell your friends!

2- Write a review on Facebook, or your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage an authorised financial adviser to provide guidance around your specific goals and objectives.

_____________________________________________________________________________

Labour’s Big Mandate: here’s how they should use it. Gary Taylor, Environmental Defence Society

Few names have been associated longer with conservation and environmental protest than Gary Taylor. The executive director of the Environmental Defence Society has taken on mining companies, property tycoons, governments and even fellow conservationists with the cool-headed grit of a long-haul trucker. So what does he make of Labour’s extraordinary mandate to rule? What’s on his wishlist for action? What does he think will actually happen? And why, after so many decades of seeing environmental degradation and climate inaction, does he remain so charmingly optimistic?

Join Vincent and Gary as they traverse the Waitakere Ranges, the Hauraki Gulf, the McKenzie Country and a mercifully brief summary of the RMA reforms.

Hear the Podcast Here:

About Gary Taylor CNZM, QSO

Gary is the executive director and chairman of EDS and has extensive experience in corporate governance, having been the Chairman of the Auckland Area Health Board, the Climate Change and Business Centre (Australia) and the Peoples Centre Health Trust. He has been a director of Watercare Services Ltd, Infrastructure Auckland, the Queen Elizabeth National Trust, the Auckland Regional Transport Authority and the Hobsonville Land Company. He has also been a city and regional councillor. Gary is an experienced environmental policy analyst and consultant and is currently Executive Director of EDS.

Gary was awarded a Companion of the New Zealand Order of Merit in the 2019 Queen’s Birthday Honours.

About the Climate & Business Conference

EDS’ signature event Climate and Business is happening November 11-12.

The 2020 Climate Change + Business Conference will explore the extent to which businesses, policy-makers, and civil society have seized the opportunity to transform our future. Among other things, it will consider:

- the flow of Government funding toward recovery projects;

- the impact of recent policy and legislative changes;

- international recovery trends;

- perspectives from the Climate Change Commission;

- revised climate science projections;

- impacts on the price of carbon and carbon markets;

- sectoral issues and opportunities; and

- our adaptation preparedness.

CCBC 2020 will confront these issues. In doing so, it will provide opportunities for progressive business leaders to profile their ideas and innovative responses, and for businesses seeking to collaborate on their transition.

See the programme here.

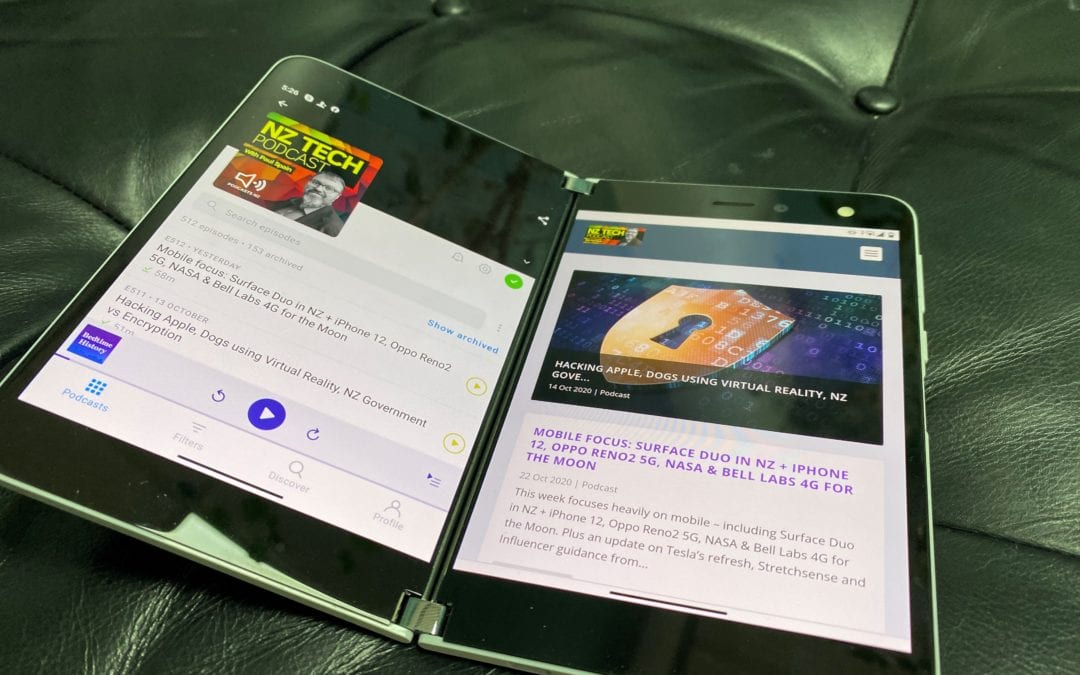

Mobile Focus: Surface Duo in NZ + iPhone 12, Oppo Reno2 5G, NASA & Bell Labs 4G for the Moon

This week focuses heavily on mobile – including Surface Duo in NZ + iPhone 12, Oppo Reno2 5G, NASA & Bell Labs 4G for the Moon. Plus an update on Tesla’s refresh, Stretchsense and Influencer guidance from Advertising Standards Authority with Paul Spain and guest Henry Burrell (BusinessDesk).

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Sumo Logic

HP

Samsung

Vodafone NZ

Spark NZ

Vocus

Gorilla Technology

The Phoenix Foundation: Friend Ship.

Much-loved kiwi icons The Phoenix Foundation are back with their first new album in five years, Friend Ship, has just been released.

Since their last album Giving Up Our Dreams, they have been writing, recording, touring with a Symphony Orchestra, creating the acclaimed soundtrack for Hunt For The Wilderpeople, building shrines to light, creating scores for VR and producing other bands.