Hadleigh Ford, CEO & Founder – SwipedOn

Listen in on a discussion between Paul Spain and special guest Hadleigh Ford – founder and CEO of NZ Tech Startup SwipedOn; who were reported as having been acquired by UK based Smartspace Software for $11 million.

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Umbrellar Connect

Vodafone NZ

HP

Spark NZ

Vocus

Gorilla Cyber Security

Datacom

Palo Alto Networks

Finfluenza! Episode 166

Finfluenza, a viral infection of pandemic proportions, or just a bunch of amateurs talking about money?

Finfluenza, a viral infection of pandemic proportions, or just a bunch of amateurs talking about money?

Surely what podcasters do MUST make professional broadcasters cringe? Heck, I make myself cringe!

Finfluencers shouldn’t make financial advisers cringe – I think this is unwise. First you mock them…

From a regulators point of view this is where it get’s tricky. Check out the guidance issued by the FMA here (Financial Markets Authority) – an important read for the consumer but also for the content producer.

Special thanks to Ryan Melton, host of the NZ Guide to Financial Freedom and NZ Audio Editors.

_____________________________________________________________

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

Peter Williams Sounds Off

New Zealand celebrity television and radio broadcaster and top ranked amateur golfer, joins Telfer & Hyde to give his take on there the game of the top names in the game are at following on from the US Open and leading up to the Open Championship. Does anyone care about golf at the Olympics? And what’s up with Kiwi pros on tour? Is Lydia Ko making a comeback or not?

Listen now:

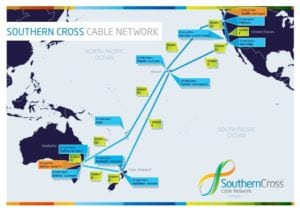

NZ Tech News, Opinions and Reviews with guest Sarah Putt

Paul Spain and Sarah Putt discuss R&D Tax Credits, Autonomous Weapons, Southern Cross Next, CIO 50 plus hands on with Dyson V15, HomePod Mini, M1 MacBook, iPad Pro, Oppo A74 5G, Oppos A54 5G, Mi 11, Mi11 Ultra.

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Datacom

Palo Alto Networks

Umbrellar Connect

Vodafone NZ

HP

Spark NZ

Vocus

Gorilla Cyber Security

NZ Sales & Marketing Insider – Episode 12: Brianne West

Ben speaks to Brianne West, founder of Ethique, on the power of purpose in sales and marketing. With the sustainable Ethique beauty brand now sold in over 20 countries and in more than 4,000 stores, Brianne shares her thoughts on the journey of Ethique’s sales and marketing – starting from making the first products in her kitchen to now being on track to prevent 50 million plastic bottles from being manufactured by 2025.

Listen or Subscribe Free:

Taxing Digital Assets / Ep 165 / Craig MacGregor

Taxoshi is a new tool that everyday investors can use to make tax time just a little bit easier with respect to their cryptocurrency holdings.

Myth one: You don’t have to pay tax on your digital assets – busted

Myth two: You pay tax on gains, but cannot offset any losses – busted

Myth three: It’s too complicated to pay tax on digital assets – busted

Giving to Caesar, what is due to Caesar, can be rather tough.

Perhaps, some attracted to investing in digital assets like Bitcoin are attracted as it’s ‘outside the system’ characteristics.

Added to this dilemma has been that the tax rules are a bit ambiguous and likely need time to be fine-tuned. Last year the IRD requested information from crypto on-ramps like Easy Crypto, “so we can work out how best to help taxpayers meet their income tax obligations”

So, paying tax on something outside the matrix is not natural impulse for some (I’d like to suggest you need to make this natural fyi!), the rules are clearer, but still could do with further refinement, and the last issue is that technically, it’s a bit hard to collect the information required for tax compliance.

Introducing Taxoshi – something that’s going to make compliance with tax so much easier. Craig MacGregor, the founder of Taxoshi, is my guest today.

We only talk about tax 20% of the time don’t worry!

Three things for further investigation today:

- Visit taxoshi.com to use the service, input NZEI into the checkout to get a 10% discount.

- Check out the guidance note issued by the IRD on this topic

- I recommend Easy Crypto for any Crypto buyer based in NZ (as mentioned in this show)

Wellington’s Not-So Secret Ramen Popup

Welcome again to the Kiwi Foodcast. Today on the show we have Kevin Ngadisastra, one half of the duo behind the Popup that has been taking Wellington by storm, Townhouse Ramen. Kevin’s ramen journey began in 2016 with a trip to Japan. But he is actually a systems analyst by day and not a chef! How did Kevin’s love affair with ramen begin? Can you run a successful food business if you also work full time? How can YOU score a seat at one of his pop ups? Let’s chat to him and find out!

Listen to the Podcast Here:

Favourite Quotes:

“I wanted to name the popup Kevin Ramen at the time, but my partner wasn’t too fond of the idea”.

“We use an app to export our comments on Instagram into our spreadsheet. I then wrote some code that would choose the people we invite to the popup. It’s a bit nerdy, but I love my spreadsheets! It was a way of managing all the demand”.

“There is not really a day that goes by when I don’t think about ramen. Making ramen from scratch is a lot of work. The broth can take anywhere from eight to sixteen hours, the eggs take three days to marinate, and the noodles take ages too. It’s definitely a labour of love”.

Green, keen and clean: EcoStore’s Tony Morpeth

EcoStore’s Tony Morpeth has been making environmentally friendly household cleaners for more than 20 years. Back then he was a pioneer, working for Stephen Tindall and then Malcolm Rands. Now his products are in pretty much every supermarket, from here to New York. So what goes into an eco-cleaner, and what stays out? And how can EcoStore can stay ahead of the competition and keep driving to green, but very clean world?

Plant & Mineral-Based Home, Body and Baby Care | ecostore NZ

Hear the Podcast Here:

News of the Money-World/ Ep 9 / Home-Buying-Bubble-Conundrum

Welcome to a short fortnightly series in addition to the weekly show. In partnership with Koura Wealth, your digital KiwiSaver provider, The NZ Everyday Investor is proud to present, News of The Money-World, a show about what’s happening in the finance world and how that affects you, the everyday Kiwi.

Canada, Sweden, and New Zealand – we’re in the top 3 here for all the wrong reasons.

So many ways to look at this – but let’s say New Zealand Inc traded on the NYSE…relative to many other ‘stock’s ‘, the theory goes, we’re a little over valued.

So what caused it, what’s now being used to treat it, will it work, and what shall we home-buyers do while they wait for the market’s health to stabilise?

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Tell your friends!

2- Write a review on Facebook, or your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage an authorised financial adviser to provide guidance around your specific goals and objectives.

__________________________________________________________________

Where to find Darcy Ungaro:

Ungaro &Co (authorised) financial advisers

Want to chat, then you can schedule in a free 15 min conversation just click on this link

You really should subscribe to our newsletter to ensure you are receiving the latest updates if you’re a fan of the show.

Stefan Powell – Dawn Aerospace NZ

Paul Spain sits down with Stefan Powell of Dawn Aerospace to learn a little of what it takes to establish a new space startup in New Zealand. Stefan delves into a wide range of topics including the Aurora Spaceplane.

Special thanks to organisations who support innovation and tech leadership in New Zealand by partnering with NZ Tech Podcast:

Datacom

Palo Alto Networks

Umbrellar Connect

Vodafone NZ

HP

Spark NZ

Vocus

Gorilla Cyber Security

The Insider: Pippa Coom on the gap between Auckland’s climate words and actions

Pippa Coom is a rare Auckland Councillor who is championing climate change action and a faster shift to active transport. So how does she rate the council’s actions on transport, buildings, and climate justice? And what’s it like to be an activist on the city’s front bench? Pippa is deputy chair of the Auckland Sustainability and Climate Change Committee and co-chair of the Hauraki Gulf Forum.

Before entering politics, she was a lawyer with Vector Energy and a community organiser of sustainability events, including Frocks on Bikes.

Hear the Podcast Here:

How We Did It / Episode 163

Stephven, Donna, Ricky Bobby, and Texas Ranger – a normal Auckland family, who are anything but average. Today’s show is about how THEY did it. How they got onto a track which they now believe will place them exactly where they need to be at time of retirement.

Financially conservative people often seek comfort in a spreadsheet which soon becomes their master, eventually resulting in in-action. Risk takers on the other hand, have no issues with taking action, but could often do far better with a little more planning. Once again, the solution isn’t in the investment, it’s within the investor.

In this episode, hopefully you’ll see the importance of receiving advice – more important to just receiving this advice however, is the need to ensure the advice can turn what may be considered a weakness, into a strength.

In the episode, I suggested one of the ways you could locate an adviser for your needs would be to visit Financial Advice NZ for a comprehensive list that doesn’t discriminate around areas of speciality or remuneration models.

If you would like to enquire around working with Darcy (financial adviser), you can schedule in a free 15 min conversation just click on this link

The NZ Everyday Investor is brought to you in partnership with Hatch. Hatch, let’s you become a shareholder in the world’s biggest companies and funds. We’re talking about Apple and Zoom, Vanguard and Blackrock.

So, if you’re listening in right now and have thought about investing in the US share markets, well, Hatch has given us a special offer just for you… they’ll give you a $20 NZD top-up when you make an initial deposit into your Hatch account of $100NZD or more.

Just go to https://hatch.as/NZEverydayInvestor to grab your top up.

____________________________________________________________

Like what you’ve heard?

You can really help with the success of the NZ Everyday Investor by doing the following:

1- Follow @darcyungaro on Clubhouse.

2- Write a review on Facebook, or on your favourite podcast player

3- Help support the mission of our show on Patreon by contributing here

4- To catch the live episodes, please ensure you have subscribed to us on Youtube:

5- Sign up to our newsletter here

NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!

Please ensure that you act independently from any of the content provided in these episodes – it should not be considered personalised financial advice for you. This means, you should either do your own research taking on board a broad range of opinions, or ideally, consult and engage a financial adviser to provide guidance around your specific goals and objectives.

If you would like to enquire around working with Darcy (financial adviser), you can schedule in a free 15 min conversation just click on this link

_____________________________________________________________________________