In economics there’s something called the ‘spill-over effect’ – something that happens to other people, as a result of you going about your business. This can be good (positive externality) or bad…

Private equity activity has a positive impact on the public indirectly, when firms in search of good return for their investors, invest in small to medium sized enterprises (SME’s). These businesses, many who are innovators not just in NZ but worldwide, will constantly require capital to grow. Forget shark tank, these are real businesses with real turnover, who are likely employing real NZ’ers (loads of them!). SMEs make up about 97 per cent of businesses in New Zealand and almost 70 per cent of them are single-worker businesses (see http://www.stuff.co.nz/business/10198006/SMEs-still-backbone-of-NZ-business).

We’re so pre-occupied with profits staying in NZ that we’ve forgotten the thing that every Kiwi needs to survive – income. If the backbone of our economy (SME’s) are not equipped to grow, what then? They either go off-shore, get bought by off-shore interests, or shut down. So by supporting SME’s, we’re ensuring jobs stay in NZ. Currently SME’s don’t receive all the support they need in NZ.

What about the NZ Super Fund and Kiwisaver providers? There’s huge amounts of capital here in search of a rate of return for stakeholders but there’s no mandate for them to invest in NZ businesses. The government is far more into start-ups – That makes for great headlines and scores some points perhaps but what about businesses who are actually already successful – shouldn’t we back our winners first?

As everyday investors, even we have a role to play in supporting SME’s – putting pressure on Kiwisaver providers to provide options which are NZ SME supportive would be a good start! Being able to choose, possibly through an open-sourced framework, where are Kiwisaver funds are deployed (multiple providers?) would also be good. It’s not enough to be a low cost model for Kiwi’s to access overseas investment options – these days I think smart Kiwi’s will start demanding responsible and socially profitable investment opportunities here. It’s arguably the best way we can support our economy – if we grow the size of the pie, we all win!

Listen to Part One above

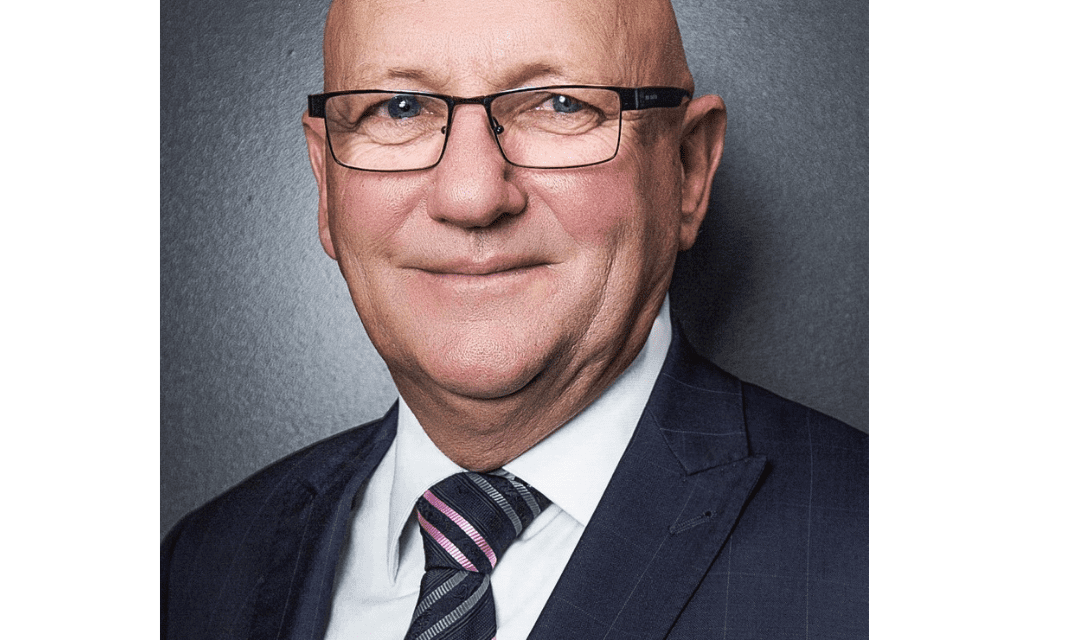

So Tim Preston is one of the principles of CM Partners – an independent boutique corporate and capital markets advisory firm that provides a full range of services to small to medium New Zealand businesses. Enjoy the show!

Listen to Part Two above

Where to find Tim: https://cmpartners.co.nz/#about

NZ Everyday Investor Podcast:

https://www.facebook.com/NZ-Everyday-Investor-338969376637717/

We’re keeping it real on NZ Everyday investor – we’re not journalists and this isn’t an interview – it’s a discussion, hosted by someone who’s genuinely into this sort of thing. If you like what we do, remember to subscribe to our show and share it with others – we’d really appreciate it! You know what else would be make us rather pleased with ourselves? Write a review on facebook too!

Where to find Darcy Ungaro:

Ungaro &Co (registered) financial advisers https://www.ungaro.co.nz

Facebook: https://www.facebook.com/UFinServ/?ref=bookmarks

Instagram: https://www.instagram.com/ungaro.co.nz/

Help support the mission of our show on Patreon by contributing here: NZ Everyday Investor is on a mission to increase financial literacy and make investing more accessible for the everyday person!