A new biodiversity credit – Sean Weaver and Helen Hughes

In June, the government announced nine pilots to trial a voluntary nature credits scheme – the closest so far to a biodiversity credit. Led by Act MP and Associate Minister for the Environment Andrew Hoggard, the government says it wants to establish ‘a market that is durable, measurable and transparent to help farmers, landowners, iwi, and conservation groups unlock new income streams for looking after nature on their land.’ One of the nine is the Sanctuary Mountain Maungatautari Biodiversity Credit project an international trade-ready biodiversity credits scheme developed by advisory firm Ekos. It launched officially launch on 24th of June and Vincent is joined by Ekos found Sean Weaver and Sancturary Mountain CEO Helen Hughes.

Government announcement here

Ekos & Sanctuary Mountain media release here

Francis Hunt / Global Debt Meltdown? Ep 475

Book in a free 15-min phone call with Darcy Ungaro (financial adviser).

Sign up to the fortnightly newsletter!

Thank You Provincia: Whether you’re looking to invest, or you have a commercial property that needs better management – they the true one-stop shop for wholesale industrial investors. Check out Provincia.co.nz for more.

Affiliate Links!

The Bitcoin Adviser: Plan for intergenerational digital wealth.

Hatch: For US markets.

Sharesies: For local, and international markets.

Easy Crypto: To buy and sell digital assets.

Sharesight: For tracking and reporting on your portfolio

Exodus: Get rewards on your first $2,500 of swaps

Revolut: For a new type of banking.

Online courses:

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence

Get Social:

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

________________________

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account.

Ideally, engage a financial adviser / pay for advice!

________________________

Listen to NZ Everyday Investor Podcast:

Dental as anything – Laura Nixon, Solid

Everyone’s got an idea for a business at some point in their life. Laura Nixon did something about it. A hygienist, troubled by the volume of plastic waste in the dental sector, Laura founded Solid, which replaces unrecyclable plastic tubes with toothpaste tablets and powder in glass jars. Solid’s product lineup includes the world’s first in-store toothpaste dispenser, and teeth whitener.

Solid was a finalist in the Sustainable Business Awards and was included in the exciting SBN Next 95 list of innovators.

Darcy Ungaro / 2 Ways 2 Grow Obscene Wealth, Ep 474

I believe the core ingredient in any wealth building strategy is the acquisition of just a few assets. As we acquire assets, we need to start thinking more, not less, about all the things that rob us, and no, not just fees.

Catch the full Michael Saylor talk here

Book in a free 15-min phone call with Darcy Ungaro (financial adviser).

Sign up to the fortnightly newsletter!

Thank You Provincia: Whether you’re looking to invest, or you have a commercial property that needs better management – they the true one-stop shop for wholesale industrial investors. Check out Provincia.co.nz for more.

Affiliate Links!

The Bitcoin Adviser: Plan for intergenerational digital wealth.

Hatch: For US markets.

Sharesies: For local, and international markets.

Easy Crypto: To buy and sell digital assets.

Sharesight: For tracking and reporting on your portfolio

Exodus: Get rewards on your first $2,500 of swaps

Revolut: For a new type of banking.

Online courses:

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

The KiwiSaver Millionaire Roadmap: Get a Rockstar Retirement!

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence

Get Social:

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

________________________

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account.

Ideally, engage a financial adviser / pay for advice!

________________________

Listen to NZ Everyday Investor Podcast:

The latest from HP – AI, partnerships and brand changes

Hear from host Paul Spain and Brett Blackman, (HP NZ) as they explore HP’s latest innovations—ranging from AI-powered features like the HP AI Companion, which promises to boost productivity and offer new levels of privacy and control, to the ongoing evolution in printing and sustainability. Brett shared insights into HP’s work with major hardware partners, the importance of built-in security with tools like HP Wolf Security, and HP’s product rebranding from Spectre and Pavilion to OmniBook.

Whether you’re a tech enthusiast, a business owner, or simply curious about how technology shapes our daily lives, you’ll find plenty of practical takeaways and fascinating stories as Paul and Brett discuss everything from gaming laptops and retail experiences to the future of AI at HP.

Special thanks to our show partners: One NZ, 2degrees, Spark NZ, HP, Workday and Gorilla Technology.

Darcy Ungaro / The Inevitability of Investment Returns, Ep 473

Recently, I attended a conference which centered on what I suspect will be the future of money in a more digital world. One of the best presentations I sat through was from author (of a book called ‘Broken Money’) and macro-analyst Lyn Alden – ‘Nothing stops this train’. The current form of money we use (fiat currency) is tethered to a leveraged system with no easy way to deleverage. Ironically, the strategy we can use as households to build wealth (leverage to buy scarcity) is what may help our governments survive the train wreck coming. Read more.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser).

Sign up to the fortnightly newsletter!

Thank You Provincia: Whether you’re looking to invest, or you have a commercial property that needs better management – they the true one-stop shop for wholesale industrial investors. Check out Provincia.co.nz for more.

Affiliate Links!

The Bitcoin Adviser: Plan for intergenerational digital wealth.

Hatch: For US markets.

Sharesies: For local, and international markets.

Easy Crypto: To buy and sell digital assets.

Sharesight: For tracking and reporting on your portfolio

Exodus: Get rewards on your first $2,500 of swaps

Revolut: For a new type of banking.

Online courses:

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

The KiwiSaver Millionaire Roadmap: Get a Rockstar Retirement!

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence

Get Social:

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

________________________

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account.

Ideally, engage a financial adviser / pay for advice!

________________________

Listen to NZ Everyday Investor Podcast:

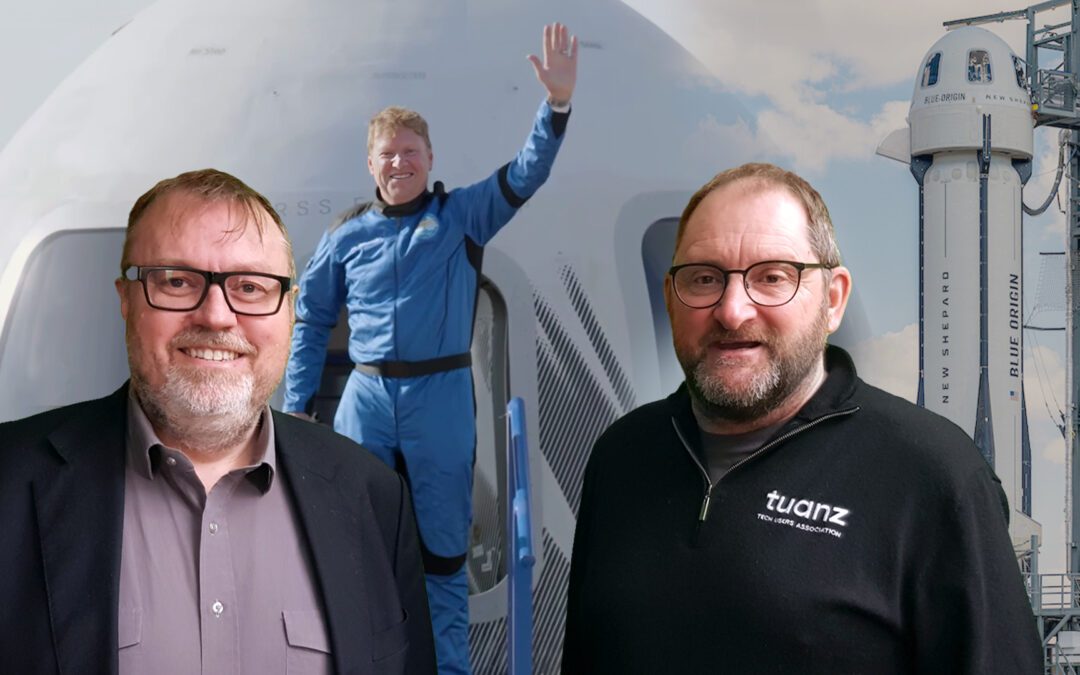

New Zealand’s First Space Tourist and Aotearoa’s Digital Future

Host Paul Spain is joined by Craig Young (TUANZ) to discuss New Zealand’s expanding role in tech and aerospace. The conversation covers Rocket Lab’s latest developments, Tesla’s autonomous vehicle trials in Texas, the complexities of balancing online safety for children with privacy concerns and the latest on what’s happening within TUANZ, including efforts to improve digital connectivity and tackle issues of affordability and access across Aotearoa.

Plus hear Paul’s exclusive interview with Mark Rocket, NZ’s first astronaut and space tourist, as he shares what it’s like to launch into space, experience zero gravity, and look back on our planet from above.

Special thanks to our show partners: One NZ, 2degrees, Spark NZ, HP, Workday and Gorilla Technology.

Mike Grimshaw / Has NZ Lost Its Way? Ep 472

Has New Zealand lost its way? If so, the only path forward is to honestly acknowledge what we once were, understand how and why we’ve changed, and then chart a course for the future we want. It’s a tough question, no doubt, but like any hard problem, there’s a reward waiting on the other side. I’m joined today by Mike Grimshaw, a self-confessed ‘intellectual mongrel’ and Associate Professor of Sociology at the University of Canterbury, whose eclectic work spans radical theology, cultural theory, and New Zealand’s identity.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser).

Sign up to the fortnightly newsletter!

Thank You Provincia: Whether you’re looking to invest, or you have a commercial property that needs better management – they the true one-stop shop for wholesale industrial investors. Check out Provincia.co.nz for more.

Affiliate Links!

The Bitcoin Adviser: Plan for intergenerational digital wealth.

Hatch: For US markets.

Sharesies: For local, and international markets.

Easy Crypto: To buy and sell digital assets.

Sharesight: For tracking and reporting on your portfolio

Exodus: Get rewards on your first $2,500 of swaps

Revolut: For a new type of banking.

Online courses:

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

The KiwiSaver Millionaire Roadmap: Get a Rockstar Retirement!

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence

Get Social:

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

________________________

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account.

Ideally, engage a financial adviser / pay for advice!

________________________

Listen to NZ Everyday Investor Podcast:

NZ Hi-Tech Award winners, Open AI acquisitions, and Brain drinks

Host Paul Spain sits down with Angus Brown, co-founder of Ārepa, a New Zealand-based brain food technology company blending neuroscience, cutting-edge nutrition, and food tech innovation. Together, they discuss the journey of Ārepa, their mission to improve brain performance through scientifically backed products. Plus, a look at the latest tech news, including:

- 2025 NZ Hi-Tech Award winners Inside the Tauranga drone company 1News

- Litmaps’ funding success

- One NZ’s AI Trust report – one-nz-ai-trust-report.pdf

- West Auckland’s Datacentre

- OpenAI’s strategic acquisition of Jony Ive’s hardware startup

- Discover highlights from Google I/O 2025 Come to Life with Veo | What If?

- Insights on Microsoft’s AI plans.

Congratulations to all the NZ Hi-Tech Award winners:

PwC Hi-Tech Company of the Year

Winner: SYOS Aerospace

Xero Hi-Tech Young Achiever

Winner: Luke Campbell (Co-Founder & CEO of VXT)

Spark Best Hi-Tech Solution for the Public Good

Winner: Optimation

Consult Recruitment Best Contribution to the NZ Tech Sector

Winner: Talent RISE

Datacom Hi-Tech Inspiring Individual

Winner: Lee Timutimu

Aware – an HSO Company Most Innovative Deep Tech Solution

Winner: Kitea Health Dr. Simon Malpas – Entrepreneur and CEO at Kitea Health – NZ Business Podcast

Poutama Trust Hi-Tech Kamupene Māori o te Tau – Māori Company of the Year

Winner: Deep Dive Division

Tait Communications Flying Kiwi

Recipient: Sir Peter Beck Peter Beck: Rocket Lab Founder/CEO – NZ Business Podcast 38 – NZ Business Podcast

NZX Most Innovative Hi-Tech Creative Technology Solution

Winner: The Village Goldsmith

Duncan Cotterill Most Innovative Hi-Tech Software Solution

Winner: Toku Eyes AI Innovation in Healthcare with Toku Eyes – NZ Tech Podcast

Highly Commended: Carepatron

Braemac Most Innovative Hi-Tech Manufacturer of the Year

Winner: The Village Goldsmith

Kiwibank Most Innovative Hi-Tech Solution for a More Sustainable Future

Winner: Cleanery

NZTE Most Innovative Hi-Tech Agritech Solution

Winner: Mindhive Global

Punakaiki Hi-Tech Start-up Company of the Year

Winner: Mindhive Global

ASX Hi-Tech Emerging Company of the Year

Winner: Projectworks

Highly Commended: Calocurb

Special thanks to our show partners: One NZ, 2degrees, Spark NZ, HP, Workday and Gorilla Technology.

Ashley Church / RIP NZ Property Market? Ep 471

In a perfect world, housing would be for lifestyle, and investments for long term planning – regardless, we live in an imperfect world. The real question becomes – what’s your response to it? Jump in for number go up? If so, now’s looking really, really good. *Just keep a lazy eye some of the bigger changes a foot. Read more here.

Check out the work of Ashley Church here.

Book in a free 15-min phone call with Darcy Ungaro (financial adviser).

Sign up to the fortnightly newsletter!

Special Thank You to show partner, Provincia: Whether you’re looking to invest or you have a commercial property that needs better management – they the true one-stop shop for wholesale industrial investors. Check out Provincia.co.nz for more.

Affiliate Links*!

The Bitcoin Adviser: Plan for intergenerational digital wealth.

Hatch: For US markets.

Sharesies: For local, and international markets.

Easy Crypto: To buy and sell digital assets.

Sharesight: For tracking and reporting on your portfolio

Exodus: Get rewards on your first $2,500 of swaps

Revolut: For a new type of banking.

*Some links create a financial benefit.

Online courses:

The Home Buyers Blueprint: Get a better home; Get a better mortgage.

The KiwiSaver Millionaire Roadmap: Get a Rockstar Retirement!

New Wealth Foundations: Personal finance from a wealth-builder’s perspective.

Take the free, 5-part online course Crypto 101: Crypto with Confidence

Get Social:

Check out the most watched/downloaded episodes here

Follow on YouTube , Instagram, TikTok: @theeverydayinvestor, X (@UngaroDarcy), LinkedIn.

________________________

Disclaimer: Please act independently from any content provided in these episodes; it’s not financial advice, because there’s no accounting for your individual circumstances. Do your own research and take a broad range of opinions into account.

Ideally, engage a financial adviser / pay for advice!

________________________

Listen to NZ Everyday Investor Podcast:

Sir Ian Taylor – Founder & Managing Director at Animation Research Ltd

Host Paul Spain sits down with Kiwi innovator Sir Ian Taylor. From his humble beginnings in rural New Zealand—where he vividly recalls the first time his family home was lit by electricity—to founding Animation Research Ltd and revolutionising sports broadcasting technology worldwide, Ian shares tales of pivotal life decisions, setbacks, lessons in leadership from the army, and how Māori values have shaped his business philosophy. Sir Ian’s story is a powerful reminder to follow your curiosity, look for opportunity in every challenge, and—above all—to get out of bed and seize the day.

Listen to the Podcast Here:

Paul Spain – LinkedIn

Paul Spain – LinkedIn

Paul Spain – CEO, Business & Tech Commentator, Futurist

You can keep current with our latest NZ Business Podcast updates via Twitter @NZ_Business, the NZ Business Podcast website.

Why is Zespri trialling biochar?

Biochar is a much-touted but rarely used carbon-rich material derived from organic waste, great for soil health. Kind of like charcoal it’s the result of slow, anaerobic burning. But it has not yet been widely tested in perennial tree or vine crops. Until now. Zespri has been trailing biochar as part of new innovation programme. This project aims to assess the impact of biochar application in kiwifruit orchards when applied with and without the addition of compost, looking at its effect on soil characteristics and fruit production, as well as the economics of application. The results will give growers increased confidence when trialling this promising product and also reinforce Zespri’s leadership in sustainable farming practices.

Vincent spoke to Eu Jin Cheah, Global Leader, New Values Opportunities and Bryan Parkes, Head of Innovation Acceleration, both at Zespri.

See the innovation fund here: https://www.zespri.com/en-NZ/zagfund